(Re)in Summary

• Increasing natural catastrophe losses are leading APAC insurers to explore AI, machine learning, and data-driven approaches for improved climate risk management.

• Firms such as 7Analytics, Fathom, and Ecopia.AI offer solutions that could improve data accuracy and risk modelling.

• Quantum computing may assist insurers by resolving complex issues more quickly, potentially enhancing catastrophe risk modelling and forecasting.

• A gap remains between traditional systems and startup solutions, which needs to be addressed.

• Insurers should also scrutinise vendors’ models for transparency and validation.

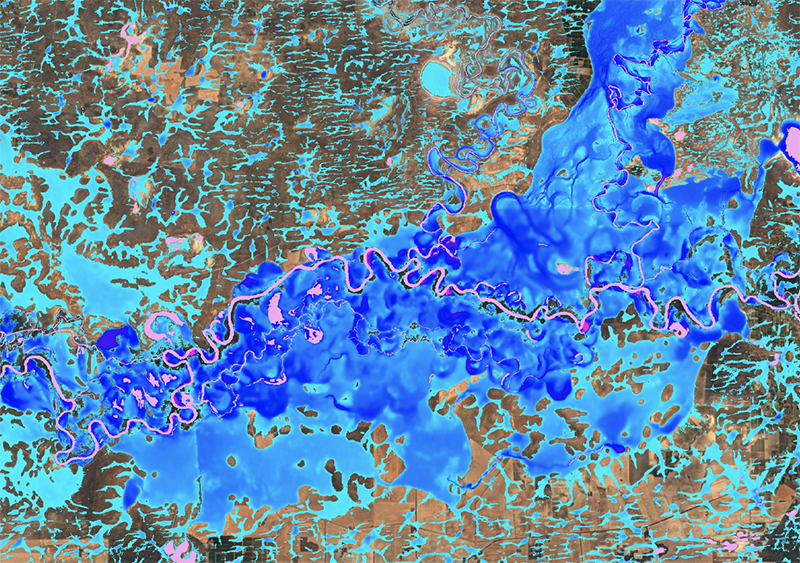

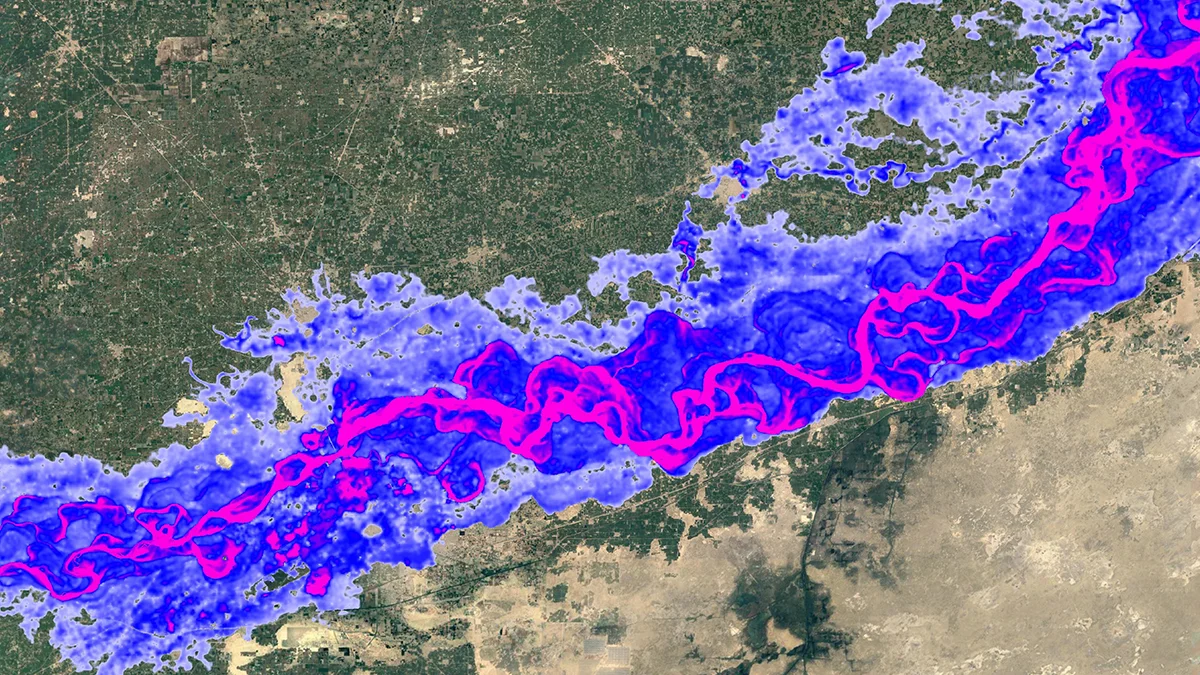

Cover image: A 1-in-200-year flood event in Pakistan | Source: Fathom

In recent years, natural disasters exacerbated by climate change have grown in frequency and severity, damaging local communities, ecosystems and economies. Asia Pacific remains one of the world’s most disaster-affected region from weather, climate and water-related hazards.

The world’s heightened nat cat risk coupled with the recent artificial intelligence (A.I.) boom has spurred a new generation of startups providing A.I. and data-driven disaster technology that aims to equip insurers with improved and more precise data and tools for managing, monitoring and modelling climate risks, translating into more effective and efficient ways to look at risk, price premiums and serve customers.

Technology mandate

Among APAC insurers, “we have seen extremely disparate approaches” in adopting data and A.I.-powered solutions for managing, monitoring and modelling climate risk, says Weihao Choo, Munich Re’s Head of Digital Solutions for P&C. Choo explains: “These differences can be attributed to data quality, resource availability, investments into climate and competing business priorities. Regulation and its emphasis on climate also play a role.”

The maturity of the Australian market, which has a 60% insurance protection gap compared to 90% across APAC, and the country’s vulnerability to natural disasters, which have caused nearly US$22 billion in insurance claims since 2010, has spurred insurers to adopt tech-forward climate risk solutions.

Weihao Choo

Head of Digital Solutions for P&C at Munich ReIn November 2024, Suncorp Australia launched its disaster management centre that integrates Suncorp data in its geospatial mapping and satellite and aerial imagery functions to use before, during and after extreme weather events. Its A.I.-powered damage detection tool, for instance, lets it pinpoint the most severely impacted communities. “During a recent storm that cut off access to a community… we were able to identify impacted customers and proactively contact them to get their claim started,” a company spokesperson told (Re)in Asia.

Still, regional insurers have long voiced a need for higher-quality data that is more granular, accurate and localised.

Providers of A.I.-powered climate risk solutions say that they can help with obtaining and parsing this data into enhanced insights for APAC insurers.

Jonas Torland

CCO and Cofounder at 7Analytics7Analytics offers climate risk tools built on unique datasets that allow insurers to price policies with “high precision,” according to company CCO and Co-founder Jonas Torland. Its granular flood risk data has helped insurers reprice their portfolios as “the real risk is not reflected in the current models available to the market,” Torland told (Re)in Asia. It has recently experienced increased demand from Australian carriers and will soon announce plans to support insurers in the wider APAC region.

Advanced algorithms and machine learning helps the firm “enhance the quality of outdated or low-precision data” that can improve the accuracy, gathering and processing of geospatial layers, providing more reliable climate risk modelling and ultimately increase underwriting profitability for insurers”, Torland says.

Fathom, a provider of data and A.I.-driven flood risk maps and models—which was acquired by Swiss Re in late 2023—uses global datasets supplemented with available local data.

“We have developed methodologies to make predictions in locations where data is unavailable“, James Savage, the company’s Principal Hydrological Model Developer, told (Re)in Asia. Its machine learning-supported flood frequency analysis can “estimate extreme river flows for any river in the world,” and its global terrain datasets used in its flood models “significantly improves the performance of models in areas that do not have high accuracy terrain data, such as LiDAR, available,” Savage says.

James Savage

Principal Hydrological Model Developer at FathomCarriers like Sompo International and Tokio Marine have used its platforms and flood data to strengthen their natural disaster mitigation products and support risk selection and portfolio management decisions in property, marine, and energy portfolios.

Geospatial mapping provider Ecopia.AI, which aims to create “a digital twin of the earth,” utilises public and privately acquired satellite, aerial and drone imagery to generate building footprints and geospatial maps, says Matt Schmidt, the company’s Senior Insurance Associate. It uses data from location and real-world features to efficiently create customised maps that help carriers analyse portfolio risk more simply and accurately, according to Schmidt.

In 2016, Ecopia “mapped every single building in Australia,” which translates into 16 million footprints, Schmidt says. “The 30,000-foot view helps insurers know where exactly the building is that they’re insuring and what other features are present in that area. They can take that and analyse all the bad things that could happen to the building,” creating a more comprehensive view of risks related to underwriting and pricing, Schmidt explains. “You can’t calculate that without having a true understanding of what’s in the built environment to begin with,” which is where geospatial mapping comes in.

Matt Schmidt

Senior Insurance Associate at EcopiaRoad ahead

Conventional natural catastrophe models remain “widespread and consistent” among insurers, says Munich Re’s Choo.

But rapid technological advancements are quickly improving the potential of predictive risk management models.

Chris Lucas

Principal Machine Learning Engineer at Fathom“Problems that have been unsolvable for years that require massive computing power, such as climate or weather simulations, can be solved through advancements in techniques like generative A.I.,” says Chris Lucas, Fathom’s Principal Machine Learning Engineer.

Machine learning models used to “tackle complex geospatial challenges have been around for several years,” Torland says. But “what truly sets today apart… is the leap in processing capabilities. He explains: “Advancements [in machine learning models] allow us to do much more with input data, such as developing upgraded methods to analyse porosity trends deep within the subsurface. It’s a dramatic improvement compared to only a few years ago.”

Simon Pink

U.K. Head of Emerging Technology at QBE VenturesEventually, technologies like quantum computing—the use of quantum mechanics to solve complex problems faster than classical computers—could help insurers with catastrophe risk modelling, says Simon Pink, the U.K. Head of Emerging Technology at QBE Ventures. “The number of variables needed for weather modelling and forecasting increases exponentially as we look for longer range forecasts. Quantum computing could harness and process the thousands of scenarios to evaluate the impacts on our customers and portfolio of business,” Pink explains.

Quantum computing and A.I. could also work in tandem in pre- and post-event processing of quantum calculations. “While A.I. is great at identifying patterns within data, some larger models depend upon massive amounts of computing power. Quantum computing uses less energy than classical computing and can process complex calculations on massive datasets,” Pink adds.

The most pressing priority for insurers now is to see the potential to improve risk assessment and pricing, “which supports sustainable (re)insurance capacity and improvements in insurance penetration,” Choo says.

Harry Vardigans

Head of Insurance at FathomFor insurers looking to adopt new natural catastrophe models, understanding the vendor and their transparency is key, says Harry Vardigans, Fathom’s Head of Insurance. Insurers should note “how open [the vendor is] about the assumptions and limitations of its models — and how extensively its models have been validated. Insurers should hold their vendors to account and go through a tough process of model scrutinisation before licensing a model,” he says.

There’s now a “divide between the startup world and the legacy-based systems that these carriers have relied on for years, which have been profitable,” Schmidt says. “But the earth’s climate is changing and we’re seeing those profits decline. What startups can do is to refine our tools to match the needs and inputs that carriers need, and to help it fit within their existing workflows and refine their responses.”