(Re)in Summary

• The MV Maersk Saltoro’s (IMO: 9725706) breakdown while carrying 1,300 containers of cherries has created uncertainty around insurance coverage and liability between carriers and exporters.

• While cherries remain powered in reefer containers, their 30-day shelf life and delayed arrival past Lunar New Year sales could result in significant losses for Chilean exporters.

• Insurance claims are complicated by debate over whether delayed arrival constitutes damage, as many policies no longer cover losses caused by delays.

• P&I clubs face challenges with risk concentration in perishable cargo, leading to limited reinsurance capacity and additional premium requirements for temperature-sensitive goods.

• The incident has sparked a surge in interest for parametric insurance from exporters, including those in APAC, seeking better delay protection.

The breakdown at sea of the MV Maersk Saltoro (IMO: 9725706), loaded with cherries from Chile on their way to China, could lead to the largest claims ever related to reefer cargo and a ‘very large overall loss event on the horizon’ but the ultimate losses that insurers face are likely to depend on the fine print of individual policies.

The event is an unusual and nuanced one, complicated by the short shelf-life of the cargo, the nature of the shipment, and the seasonal nature of cherry sales in China. Insurers and policyholders are likely to face uncertainty until the cargo arrives at the port of Nansha.

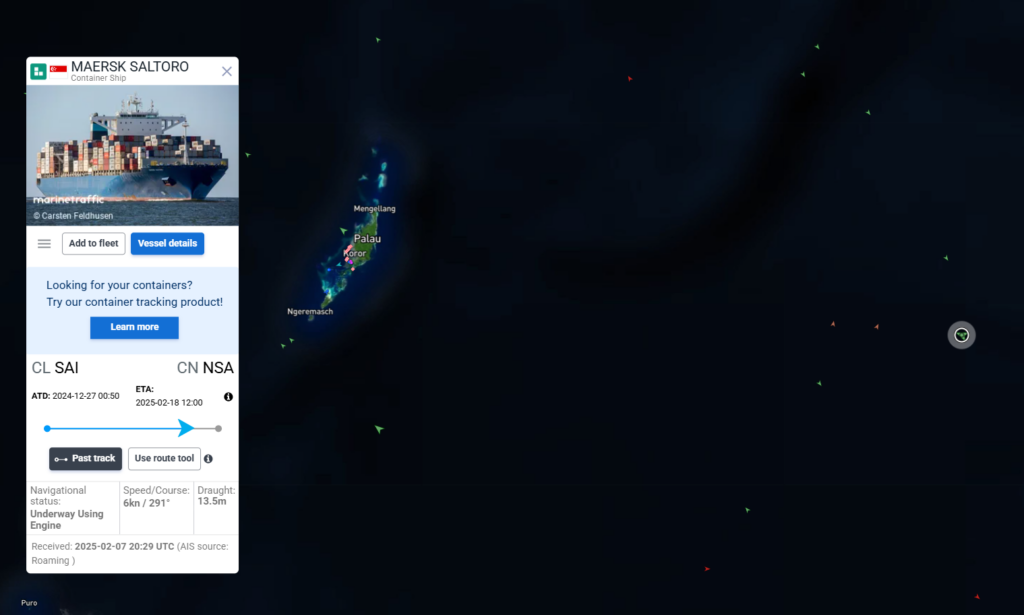

Singaporean-flagged Maersk Saltoro, one of 30 Chile-to-China Cherry Express vessels, broke down on January 13 in Micronesia while carrying 1,300 containers of Chilean cherries (along with some berries and nectarines) that have become a popular gift for the Lunar New Year in China.

The Saltoro drifted in Pacific Ocean for two weeks before getting underway again, albeit at much reduced speed.

The Saltoro’s original estimated time of arrival (ETA) at the port of Nansha was January 15, roughly two weeks before the holiday. It’s is now scheduled to arrive on February 17, more than a month late, according to a letter from Maersk to cherry producers seen by (Re)in Asia.

“This breakdown has significantly delayed the shipment, jeopardizing the timely delivery of the cherries before the Lunar New Year and causing economic concerns,” said claims management firm Barbuss, the marine claims specialist in charge of the Saltoro, in a statement on LinkedIn. The firm added that the delay in delivering the cherries could result in significant losses for Chilean exporters.

There are multiple unknowns, including how big those losses will be and what portion of those losses are covered by some type of insurance.

Just determining the value of the cargo is difficult. S&P’s Journal of Commerce estimates that there are US$60m worth of cherries on the vessel but Chilean exporters argue that the value would have been three or four times larger had the ship arrived on time to sell them for the Lunar New Year.

Assessing potential losses is also complicated by the short shelf-life of cherries, says Isabel Quiroz, Executive Director at iQonsulting and Co-Founder of iQfruits, a firm that tracks the Chinese cherry market. Quiroz is consulting with Chilean producers on the best approaches to secure insurance payouts.

Chile is the biggest producer of cherries in the world while Chinese demand has supercharged production. Cherries are shipped in a highly controlled reefer containers, but cannot keep for longer than 30 days in that environment, Quiroz says.

Isabel Quiroz

Executive Director at iQonsulting and Co-Founder of iQfruitsMaersk confirmed that the reefers were plugged in and have been continuously powered by the Saltoro’s auxiliary engines. Even so, says Quiroz, the cherries may arrive in China “looking” good but likely to spoil within hours of being unloaded from the reefers in which they travelled. And this means that the shipments are not “technically” spoiled – or damaged for cargo insurance purposes – but are practically unsellable.

“In the beginning they may look good, but cherries deteriorate very fast,” Quiroz says. Two inspections would have to be made, one when unloading the Saltoro, and another five hours later to properly assess the scale of the damage. But this is not common practice, and insurers may balk at this approach.

Adding to the complexity of any claims is the ongoing debate over who is ultimately liable. At first glance, damage to cargo is covered but a late arrival may not be considered damage and carriers are typically not responsible for the arrival date of a vessel. What’s more, notes S&P’s Journal of Commerce, insurance policies no longer cover losses caused by delays.

Concentration risk

The concentration of risk from large volumes of perishable cargo is a significant concern for P&I clubs, says Yann Barbarroux, CEO and co-founder at logistics insurtech Otonomi.ai. “A single refrigeration system failure can damage entire shipments (and) large container ships may carry perishables worth tens of millions in a single voyage,” Barbarroux says.

An event like the Maersk Saltoro creates claims challenges, as perishable cargo claims tend to be complex and expensive to investigate, he adds.

“It’s very hard to diversify risk when single vessels carry such large concentrations,” he says. “We are also witnessing limited reinsurance capacity for certain types of perishable cargo, as a large number of underwriters shy away from the perishable commodities type.”

Many P&I clubs will place limits on refrigerated cargo and require additional premiums for temperature-sensitive goods, Barbarroux adds.

Yann Barbarroux

CEO and Co-founder at Otonomi.aiUltimately, the level of coverage will be determined on a case-by-case basis and dependent on the details of individual policies, says iQonsulting’s Quiroz.

Every exporter would have a different contract, and if the fruit has spent more time in transit than what a contract states, the shipping company may be liable.

“They don’t know how the contracts are made with the shipping company and who is responsible for the fruit during transit,” Quiroz says.

Maersk, the shipping company, may face claims from individual exporters who would argue that the delay cost them millions in lost sales, but it is difficult to say how those losses would be calculated or covered. It could take years to resolve any such claims.

But another wrinkle is that, because of the delay, receivers could refuse to accept containers consigned to them, says S&P, leaving Maersk in charge of both containers and the cargo and the freight unpaid. In this event, Maersk could have its own claim against individual shippers.

Parametric interest

Regardless of how it all plays out and how the losses are attributed, broker Fester & Co expects a large overall loss event on the horizon, S&P reported.

“The insurance industry is alarmed and has activated various recourse experts to get an accurate overview of the situation,” the broker told S&P. “The technical situation of the ship, the causes and the quality of the goods play an important role. Corresponding liability claims have been formulated.”

Ultimately, insurers may only cover a small part of the loss, Fester adds, but much is up on the air until the ship arrives: “We must first get an independent overview of the extent and the actual impact before we speculate.”

“We have seen an entire wave of [parametric] quote inquiries from exporters to protect their shipment in Latin America, Asia Pacific and the West.”

Yann Barbarroux

CEO and Co-founder at Otonomi.aiBarbarroux says the Saltoro incident has already driven increased interest in parametric solutions. Traditional marine policies largely exclude delay risks, and in a case of large black swan events, require a long claim adjudication process.

In contrast, parametric solutions can offer shippers a quick payout when triggers are met, bypassing potentially complex negotiations.

“Our clients in Chile, largely shippers and perishable exporters have been concerned about the lack of protection against delays when sending high-value and critical goods alike,” he says. “We have seen an entire wave of quote inquiries from exporters to protect their shipment in Latin America, Asia-Pacific and the West.”