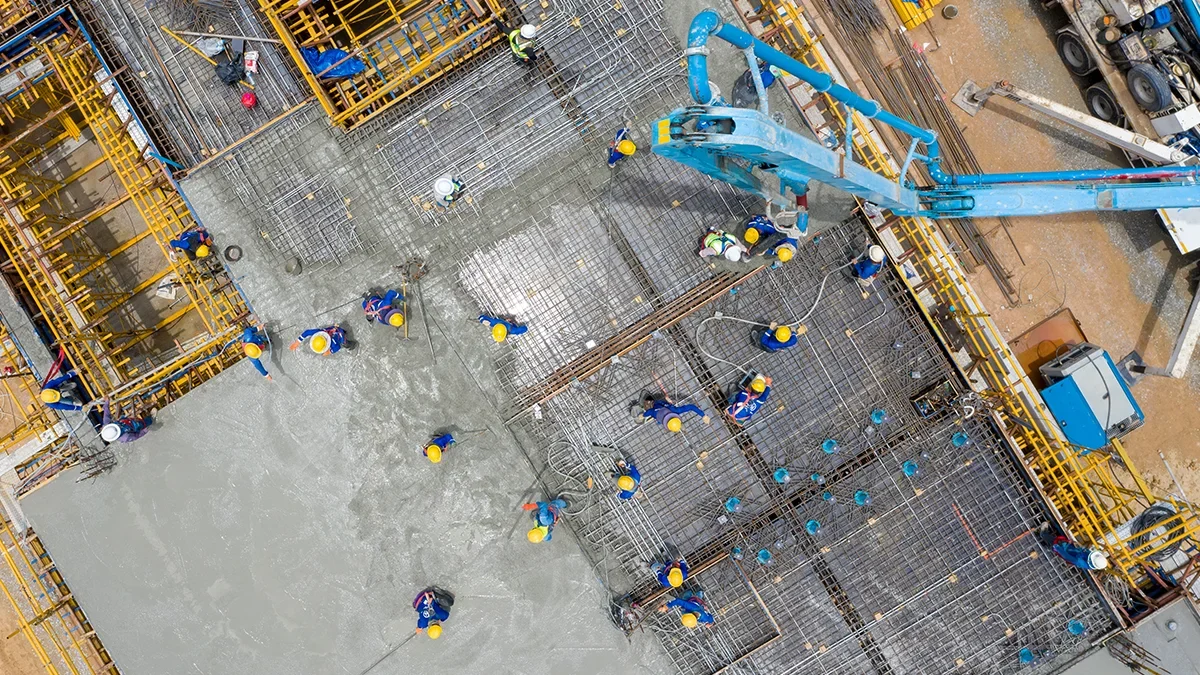

All across Asia-Pacific, large-scale engineering projects are taking place: a new nuclear power station in China’s Shandong province, a second international airport in Mumbai, a 1000-kilometre electricity transmission line across Australia, anddata centres in Malaysia.

All these projects require long-term project finance and engineering insurance. But with lingering market volatility, supply chain disruption and price uncertainty, how easy is it to manage the risk embedded in such projects?

“The push for energy transition and urbanisation, as well as advancement of technology, has enabled construction projects to become larger and more complex. Meanwhile, cost inflation and tighter budgets are affecting project financing and delivery,” says Kevin Choi, Underwriting Manager for Construction, Asia at AXA XL. “As a result, insurers are increasingly being asked to provide broader and comprehensive coverage for large-scale and complex construction projects.”

Kevin Choi

Underwriting Manager for Construction, Asia at AXA XLHandling complexity

Allied Market Research predicts that this will average a compound annual growth rate (CAGR) of 12.4% between 2022 and 2032 – the highest of any region in the world. Globally, the market is expected to expand at a CAGR of 9.2% during the forecast period.

This surge in demand for engineering insurance is directly linked to the growing size and complexity of projects that are being developed across the region. According to the G20’s Global Infrastructure Outlook, Asia will need to be spending $2.59 trillion per year by 2040 to meet development goals.

Projects such as airports, metro lines, and industrial facilities often involve international partners, with insurance support needed both within and outside of Asia.

Renewable energy projects, which are springing up all over Asia, bring complexities in terms of construction timelines, equipment availability and shifting regulatory frameworks.

There has also been a surge in the number of data centres being built, especially in Southeast Asia. Many of these require bespoke engineering insurance solutions to meet the associated operational and energy security (such as the need for a robust and stable power supply).

Choi says that the diversity and complexity of large-scale infrastructure projects in APAC drive the need for specialised underwriting expertise and localised risk solutions.

“As such, even experienced underwriters must work with risk engineers to identify potential risks, consider various foreseeable loss scenarios and estimate the MPL [Maximum Probable Loss]. This enables us to make informed decisions around appropriate coverage and deploy underwriting capacity accordingly,” says Choi.

Evolving risk

In recent years, the risk profile of large-scale engineering project has changed, becoming more complex and harder to predict.

This has led to increased demand for flexible insurance solutions that help project sponsors better manage unforeseen costs and delays. For instance, developers are also increasingly requesting the ability to be able to adjust coverage mid-project, particularly when delays or cost escalations impact the risk profile.

“Following the COVID-19 pandemic, macroeconomic volatility, inflation, and prolonged supply chain disruptions continue to impact project delivery timelines and costs — especially in developing markets,” says Choi. “Developers may pause or delay projects due to market instability or uncertainty around public infrastructure spending, particularly when there are shifts in government policy or fiscal strategy.”

Traditional insurance often does not fully address the wide range of risks that construction projects face today. While coverage can be extended through endorsements such as Delay in Start-Up (DSU), escalation clauses, or Contingent Business Interruption (CBI), these alone may not be sufficient to protect against exposures such as inflation or losses from project delays.

Choi says that, as a result, project owners and contractors are also turning to complementary solutions (such as surety bonds, credit insurance, and political risk insurance) to fill gaps that conventional policies cannot cover.

Kevin Choi

Underwriting Manager for Construction, Asia at AXA XLThe amount that firms end up spending on projects is rapidly increasing, too, principally due to significant rises in material and labour costs.

“In some cases, contractors are forced to revise, renegotiate, or even cancel their contract with project principals due to the financial pressure stemming from these macroeconomic conditions,” says Choi.

Many developers also face challenges in sourcing the parts and equipment they need to complete certain engineering projects, disrupting timeframes and leading to additional costs. This is largely due to sustained supply chain disruption, ongoing geopolitical tensions and increased demand for construction materials worldwide.

Projects involving civil infrastructure are particularly impacted, since these “often rely on highly specialised, large-scale construction equipment, such as large tunnel boring machines for tunnel projects or marine cranes for offshore wind”, says Choi.

He adds that semiconductor manufacturing facilities face procurement challenges due to the limited number of qualified equipment suppliers and extended manufacturing lead times.

“As infrastructure projects continue to grow in scale and complexity, procurement bottlenecks are becoming an increasingly important consideration for developers, risk engineers and insurers,” says Choi.

Pricing structured solutions

Those that provide these kinds of insurance solutions are having to work hard to stay on top of risk management.

“Underwriters need to be more flexible in tailoring solutions to accommodate shifting timelines and exposure levels,” says Choi. “Additionally, accurate risk assessment and pricing are more critical than ever, especially for long-term infrastructure risks that are vulnerable to inflation and geopolitical instability.”

Choi says that effective risk pricing for long-term projects requires looking along a spectrum of loss scenarios, from best to worst case. Transparent communication – between the insured, brokers and underwriters – is vital, he says.

“The pricing model should reflect the breakdown of period and value of each stage of construction work correctly,” says Choi.

For instance, to protect developers from start-up delays, insurers need to consider delivery timelines of key machinery, where such machinery is coming from and what replacement lead times might be.

“If the expected replacement time exceeds the policy’s indemnity period – typically 12 to 24 months – this must be factored into the pricing,” says Choi.

Kevin Choi

Underwriting Manager for Construction, Asia at AXA XLProject duration must also be taken into account, as longer projects tend to accumulate more claims, especially where there are high levels of third-party liability exposure.

For all of these reasons, collaboration with internal teams, engineers, actuaries, and claims specialists is fundamental to accurate pricing and better risk management, says Choi.

Advances in technology will also enable insurers to adopt more sophisticated risk assessment tools and data-driven underwriting methodologies, which will allow the market to respond more effectively to the shifting risk landscape.

“The industry will continue to grapple with persistent challenges such as macroeconomic uncertainty, political instability, climate change, and inflation—all of which have a direct impact on project costs and risk profiles,” says Choi. “The future of engineering insurance will therefore be defined by its ability to adapt and provide tailored solutions in an increasingly complex and unpredictable environment.”