(Re)in Summary

• Taiping Re, China Re, and Qianhai Re have been identified as reinsurers for the Wang Fuk Court deadly fire on Nov. 26.

• China Taiping Insurance (HK) served as the primary insurer, with AM Best estimating that total insured losses could exceed US$200 million.

• All three reinsurers have indicated they will fulfil their claims obligations to support the primary insurer’s settlement efforts.

• China’s financial regulator has issued a directive instructing China Taiping to coordinate its subsidiaries’ roles as lead institutions for both direct insurance and reinsurance in the claims response.

• Analysts expect tighter terms and a halt to softening prices for Hong Kong property reinsurance, but no capacity shortage or immediate market-wide changes.

• Reinsurers may reassess risk appetite and pricing, but changes are likely to be case-by-case, not market-wide.

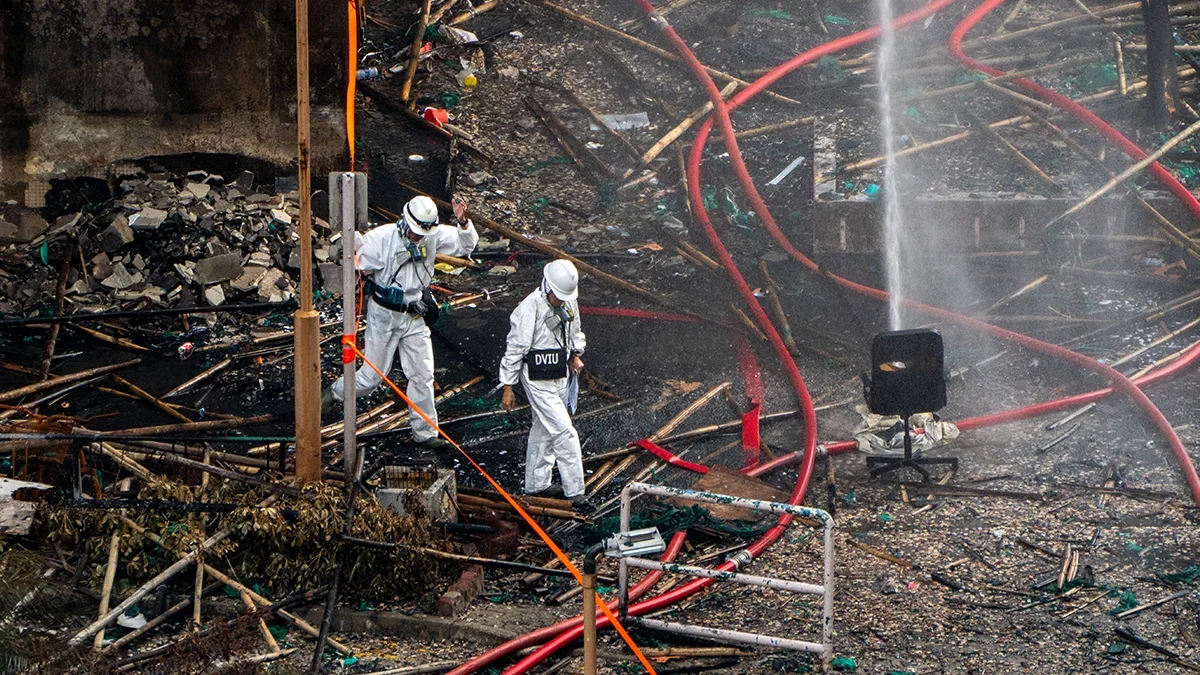

At least three reinsurance entities are providing coverage for the Wang Fuk Court residential complex devastated by last week’s deadly fire, (Re)in Asia has learned. China Property & Casualty Reinsurance Company Ltd. (China Re), Qianhai Reinsurance Co., Ltd. (Qianhai Re), and Taiping Reinsurance Co., Ltd. (Taiping Re) all confirmed as participants in the reinsurance programme.

The Nov. 26 blaze at the Tai Po housing estate, which killed at least 156 and left some 4,600 people displaced, is shaping up to be one of Hong Kong’s largest insured losses in years.

AM Best estimates suggest total insured losses could exceed US$200 million, potentially approaching half the scale of Typhoon Mangkhut’s US$400 million loss in 2018.

China Taiping Insurance (HK), rated A/Stable by S&P Global Ratings, served as the primary insurer for the buildings, underwriting property damage, third-party liability coverage for the renovation works, and various homeowner policies. But a significant portion of these losses will flow to reinsurers.

Taiping Re, a China Taiping subsidiary, has confirmed its participation in the reinsurance programme. The reinsurer said it established an emergency working group after the fire to review its exposures and retrocession arrangements, and would fulfil its claims obligations once China Taiping Insurance (HK) completes loss assessment and claims verification.

China Re provided reinsurance coverage spanning property, construction works, and third-party liability for the Wang Fuk Court renovation project, as reported by local media. Qianhai Re similarly participated in property, engineering, and liability risk transfer arrangements.

Both companies have indicated they will provide timely claims payments to support the primary insurer’s settlement efforts.

In a rare move, China’s National Financial Regulatory Administration (NFRA) issued a directive on Nov. 29 specifically instructing China Taiping to coordinate its subsidiaries’ roles as “lead institutions for both direct insurance and reinsurance” in the claims response. The government document indicates the group’s dual role as both cedant and reinsurer in this loss event through its separate legal entities.

(Re)in Asia reached out to China Taiping, China Re, and Qianhai Re for comment on their specific exposures and reinsurance arrangements. None of the companies had responded to requests for comment at the time of writing.

Emily Yi

Director at S&P Global RatingsMarket braces for changes in risk appetite and pricing

S&P Global Ratings estimates the retained losses from the fire could raise the Hong Kong non-life sector’s net combined ratio by 2-3 percentage points to 97%-98% for 2025.

But the reinsurance implications extend beyond immediate claims payments, with the incident likely to influence treaty negotiations as the January 1 renewal season approaches.

Emily Yi, Director, S&P Global Ratings, told (Re)in Asia that large loss events of this magnitude “may prompt reinsurers to reassess their risk appetite and pricing adequacy.”

However, she expects any adjustments to be handled on a case-by-case basis rather than triggering market-wide changes. “We don’t think there will be a broad-based push for higher retention, especially on adequately priced risks,” she said.

Christie Lee

Senior Director and Head of Analytics at AM BestChristie Lee, Senior Director and Head of Analytics at AM Best, shared a similar measured outlook but noted the fire is expected to halt downward pressure on Hong Kong property reinsurance rates amid a globally softening market.

“Reinsurers may respond by tightening terms and conditions,” Lee told (Re)in Asia. “However, there is abundant capacity available in the Asia reinsurance market, supported by strong capital growth and profitability among global and regional players. Therefore, we do not anticipate a reinsurance capacity shortage for Hong Kong’s property risks.”

Industry analysts pointed to a longer-term recalibration rather than immediate upheaval. Lee said the market expects stricter underwriting standards and enhanced controls on exposure accumulation going forward. She added that any reinsurance restructuring to improve cost and capital efficiency is “more likely in the medium term rather than during the upcoming January 1 renewal.”

The incident has also renewed discussion around alternative risk transfer mechanisms. Yi noted that while interest in such solutions has increased, Hong Kong’s market “remains at an early stage of development.”

The viability of alternatives such as catastrophe bonds or insurance-linked securities would depend on transaction scale, investor appetite, and cost competitiveness relative to traditional reinsurance, she said. “We have certainly seen an uptick in interest in alternative risk transfer solutions,” she added.