(Re)in Summary

• Donald Trump has secured at least 270 Electoral College votes, bringing him to the power for the second time, following his stint in office between 2017 and 2021.

• Analysts say that Trump’s return to the white house is likely to lead to greater risk volatility in Asia.

• Insurers will need to stay on top of the shifting risk environment.

• On the other hand greater risk volatility also presents fresh opportunities for insurance innovation, including for more parametric products.

• Aviation and marine insurance could be particularly affected by a realignment of supply chains.

• If Trump enacts all of his election pledge, the economic prognosis for Asia does not look good, and this is worrying insurers looking to grow in the region.

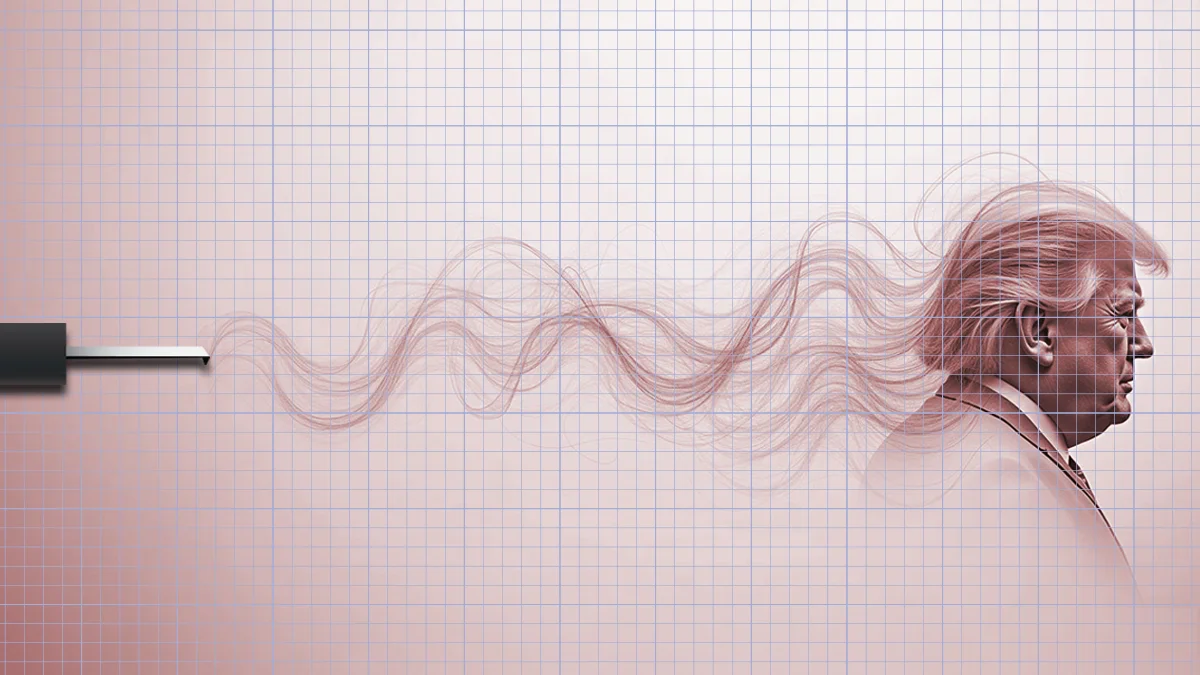

The return of the 45th president of the United States to the White House presents both challenges and opportunities for insurers in Asia-Pacific.

Trump has secured at least the 270 Electoral College votes he needs to return to the White House for a second term, following the time he spent in office between 2017 and 2021.

On the one hand, underwriters need to stay on top of the shifting risk environment. On the other hand, businesses may need additional protection from heightened risks, such as geopolitical tensions and supply chain disruption.

At the same time, many analysts agree that Donald Trump’s economic policies, as stated during his election campaign, would be inflationary and potentially damaging to the global economy.

“Any US presidential election is important in terms of what it might mean for a potential change of administration and change of US policy, which clearly has ramifications for the rest of the world,” says David Langran, a Class Underwriter at HIVE, which specialises in aviation insurance. “This is something that insurers have been looking at and monitoring, within the context of everything else that they are looking at.”

He says that the two main focus areas of this election, from a global standpoint, have been geopolitical risk and supply chain disruptions caused by a shift in economic policy.

“US foreign and economic policy have an impact for the rest of the world, including in Asia because of the region’s importance within the global supply chain,” says Langran.

David Langran

Class Underwriter at HIVESupply chain realignment

Throughout the election campaign, Trump has consistently threatened to impose more tariffs on goods from China entering the United States.

Earlier in the year, the presidential candidate said that he would impose a tax of between 10 and 20% on all goods entering the country and between 60% for goods from China. In September, Trump said he would impose a tariff of 100% on countries that turn away from the US dollar as their central bank reserve currency.

“Tariffs are the greatest thing ever invented,” said Trump during a characteristic firebrand rally in September.

The imposition of such tariffs could potentially reorder trade flows, creating new risk for insureds and changing the risk profile of insurance policies.

“Imposing higher tariffs on imports coming into the US could have a significant impact on Asia. China would almost certainly impose retaliatory tariffs. This would effectively lead to a trade war and a realignment of the global supply chain,” says Chris Don, Head of Brand and Communication at Russel Group, which models risk.

He added that this could have “potentially large implications” for marine and aviation insurance.

This means that underwriters need to have a granular understanding of how these shipping routes are changing and how this affects risk.

“If ships are no longer moving between the US and China, where are they being redirected to? How are exposures shifting? Where are opportunities for writing new business starting to emerge? Similar questions will need to be asked for aviation insurance, too,” says Don.

Singapore-based marine underwriter

A cargo marine underwriter based in Singapore, who provided comments under the condition of anonymity, confirms that shifting supply chains is something she is watching closely.

“This could mean a lot more smaller ships making shorter voyages,” she said. “On the one hand, this would reduce the exposure for the insurance company, since the period of time at which the cargo was put at risk would be shorter. On the other hand, the premiums earned would also be lower.”

Despite a buoyant year for cargo insurers last year, according to recent figures from the International Union of Marine Insurers, profitability is likely to be significantly down this year, as commodity prices have fallen and therefore the amount being insured per voyage is generally less.

Any Trump-induced disruption to the supply chain could further weaken this profitability, creating even more of an incentive for underwriters to stay on top of risk.

Political risk

Many pundits suggest that having Trump back in the White House will heighten geopolitical tension between the US and China, leading to greater political uncertainty, especially where Taiwan is concerned.

“All it needs is one misunderstanding between the US and China and the next thing you know you’re moving into a situation where China has imposed a blockade on Taiwan, which would have precisely the same effect as an earthquake,” says Don.

Chris Don

Head of Brand and Communication at Russel GroupInsurers with operations in the region are watching how this develops.

“China is of course a topic that we will be watching closely, given implications for the insureds and exposures in the region,” says Langran.

He adds that “this election has been particularly important because of the clear divergence that emerged between the two candidates”, although adds that insurers “have not been specifically focused on this election”, regarding the results as more of an additional component that feeds into the overall risk modelling.

Not everyone, however, agrees about the impact that the election of Trump might have on the Asian insurance markets.

One head of APAC for a specialty broker suggested that a belligerent Trump could actually lower the temperature with Asia, suggesting that the Chinese president Xi Jinping might be less eager to engage in sabre-rattling with someone that is prepared to stand up to him.

“Is the Trump election good or bad for the insurance industry in APAC?” said the broker. “At this stage, it’s really hard to say.”

Head of APAC at a specialty broker

The other question that people have raised is whether the trajectory Trump is now set upon would have been put in place, even if his opponent Kamela Harris had won. After all, both Harris and Trump aired concerns about China during the election campaign.

“Trump could bring things to a head more quickly, but it is possible that you would get to precisely the same point with Harris, it would just take a little bit longer. There are still likely to be major political disputes between the US and China, because they have different agendas.”

Seizing the opportunity

Greater risk and uncertainty could also provide an opportunity for insurers, too.

“We’ve already seen a greater appetite for buying in certain parts of the world, not just because of the US election but because of everything that is going on,” says Langram. “The US election is just one variable in some of those considerations that clients are thinking about. I think the broader pattern of buying and the coverage that we have to offer as insurers is evolving as the world changes, and the world probably is getting slightly more difficult or challenged. This is something that we as insurers have to respond to.”

Don says that people are actively talking about whether there is an opportunity to create new types of parametric coverages that are triggered by supply chain issues, such as the disruption of silicon production for the semiconductor industry in Taiwan.

He says that the results of the US election are likely to further increase demand for such products, which could be good news for insurers.

Economic fallout

However – and for many insurers it is a big however – the litmus test for Trump is what he does to the global economy.

Many economists argue that if Trump imposes the tariffs he said he would impose during the campaign (up to 100% on China), this would significantly harm the GDP of both economic areas – with significant ramifications for insurance.

Imposing the kinds of tarrif Trump wants to impose, argue many analysts, would significantly harm the global economy.

“Trade is what drives much of the growth of in Asia Pacific, so when economies become less receptive to trade – and specifically the US economy – that does have a huge impact,” says Stefan Angrick, a Senior Economist for Moody’s.

Prior to the election, Moody’s projected that a sweep could shave at least 3% off the GDP of developed Asian economies, including Hong Kong and Singapore.

This could significantly shrink and reduce demand for insurance, significantly shrinking the pie in Asia that (re)insurers are all vying for at the moment and dampening the opportunity benefit that some insurers are starting to see.

Head of a global reinsurer

With rates starting to stablise in the region (following two fairly tortuous years of 1/1 renewals), many insurers are now looking at how they can grow their APAC books.

“What we do here does depend on the economic outlook,” said the Asian head of one global reinsurer, speaking on the sidelines of the Singapore International Reinsurance Conference (SIRC), which was held between November 4 and November 7.

This may very well depend on whether the 45th President is prepared to put in place the policies that he fought the election campaign on – or whether they were purely part of the rhetoric that brought him to power.