(Re)in Summary

• Miller Insurance has obtained an onshore licence to enter the South Korean market.

• The Korean non-life market is similar in size to the UK, but broker penetration is lower.

• Established brokers in the market are also reporting 15-20% growth annually.

• Despite economic challenges, GIC-backed Miller sees potential in Korea’s qualitative growth and the shift to international brokers.

• The broker will focus on marine, shipbuilding, and energy insurance, leveraging Korea’s industrialised economy.

• It is also looking to expand in the sports and entertainment industry in the country.

South Korea’s insurance broking market has been growing by between 15 and 20% a year for the past few years. Miller Insurance, which obtained its onshore licence in the country on December 31, wants a slice of this pie. The acquisition of the licence was only officially announced today (January 13).

“If you look at the data for the non-life insurance industry in Korea, the size in terms of gross written premiums is roughly the same as the UK, but the size of the non-life broker market is far smaller. This presents us with a significant opportunity for growth,” says David Kim, the broker’s Head of South Korea tells (Re)in Asia.

In 2024, the size of the UK general insurance market reached £78.55 billion ($96.93bn), according to a report by Global Data. At the start of last year, Korean Re projected that GWPs in South Korea would top $100bn during the course of 2025.

At the same time insurance broker penetration in Korea is far lower than it is in the UK. Kim estimates that it might account for between $8-10bn of GWPs in the UK, whereas in Korea the broker market is in the hundreds of millions.

David Kim

Head of South Korea at MillerIn Korea brokers are required to report their revenues by law to the public each year and most have been reporting at least 15-20% growth during the past few years, according to Miller’s own assessment. In addition, Kim says that the main insurance companies in Korea (who used to have their own in-house sales employees as the key distribution channel) are reducing their in-house employees and relying more on brokers.

“Korea ticked a lot of boxes for us,” says Ron Whyte, Miller’s Head of Asia. “While Korea may not be a massively-growing economy, it is a robust and stable economy with high insurance penetration rates and low broker penetration. The broker market may be in its infancy, but it is growing exponentially as people increasingly see the value of intermediaries.”

He says this helped obtain strong support from the Group Executive and Board to move ahead with the Korean licence.

Last March, Singapore’s sovereign wealth fund GIC became Miller’s largest shareholder – an important point as the broker seeks to expand in Asia.

Ron Whyte

Head of Asia at MillerCore focus

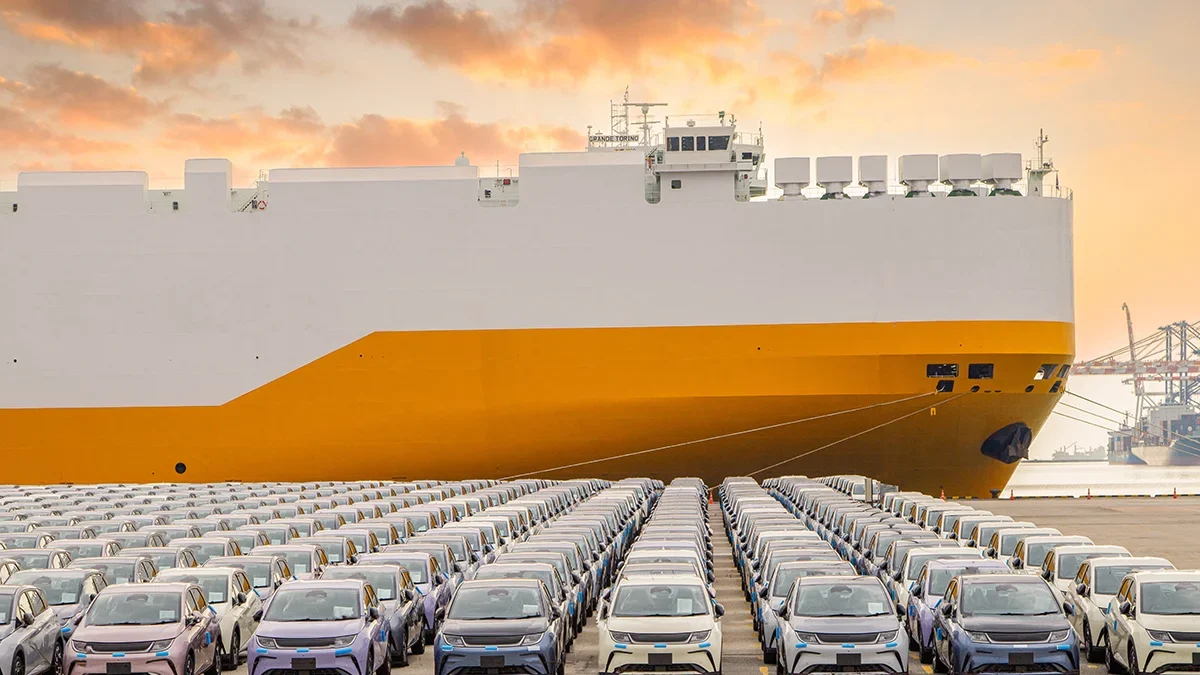

Miller is a heavyweight in marine and shipbuilding insurance across Asia, and this is where the broker will be initially focusing much of its energy as it seeks to expand in the country. Energy insurance will also be a core feature of future growth plans.

“Korea is a heavily industrialised nation, which plays to our core strengths in marine, shipbuilding and energy,” says Whyte.

Kim adds that, although the competitive dynamics in Korea are challenging, “the services we provide perfectly align with the economic needs of the country”.

Previously, Korea’s largest firms held sway over key components of the economy, such as manufacturing and construction. But as these firms have become even bigger, and decision-making has been decentralised, many have moved into new areas and dispersed their interests. This creates new opportunities for international brokers, says Kim.

Ron Whyte

Head of Asia at MillerOne area that Miller has been keen to grow in across Asia is the sports and entertainment industry. The broker recently hired Siva Krishnan in Singapore to lead this initiative.

Korea, with its vibrant and internationally-leaning entertainment scene, could be a perfect testing ground for this.

“Our sports and entertainment offering is still in its infancy in this part of the world, but we are in a good position to grow in this area. The insurance products themselves are not all that complicated. What is much more important to clients is whether a broker has sufficient penetration in the industry,” says Whyte.

David Kim

Head of South Korea at MillerMiller is already a strong player in the sports and entertainment business in Europe, having worked to place business with celebrities such as Taylor Swift and more than 20 Premier League football clubs.

“We are able to demonstrate our pre-eminence in the sports and entertainment industry globally – and this will be very important to new clients in Korea,” says Kim. “Do we have the right brand name clients? Do we cover the big stars? What major football teams do we have on our books? These are the kinds of things that we get asked first, and we have no difficulty in demonstrating our global credentials here.”

The GIC factor

Whyte and Kim acknowledge that, without the backing of a strong Asian partner, it might have been somewhat harder to break into Korea.

“Companies in Korea are used to dealing with big brand names,” says Kim. “The value that we bring to the market as a specialist broker, combined with our backing by GIC, creates that first tier of instant credibility with our clients and our trading partners, the insurance companies, who are all large, diverse conglomerates.”

Outside insurance, GIC is a heavy investor in certain core parts of the Korean economy, including real estate and the entertainment industry. Before Christmas, GIC invested more than $640 million in South Korea’s Kakao Entertainment. A couple of years ago the sovereign wealth fund teamed up with Korean investors to build a huge data centre in the country.

Economic wobbles

With nominal GDP of US$1.87 trillion, according to the International Monetary Fund, Korea is the 12th largest economy in the world and the 4th largest in Asia. Nonetheless, economic growth in the country is flagging.

According to estimates from the IMF, Korea’s economy is projected to have grown by just 2.2% in 2024. This is lower than many other countries in Asia, and below the global average of 3.2%. Political instability in the country, following the impeachment of sitting president Yoon Suk-yeol, has further taken its toll.

David Kim

Head of South Korea at MillerMiller’s management team isn’t worried, however, and says that weaker growth could even play to the broker’s advantage, as large domestic conglomerates are forced to seek opportunity overseas and expand into new industries.

“This has increased the willingness of people to use international brokers to manage their increasing complex risks and to rationalize their risk costs,” says Kim. “So, while quantitative growth may have slowed, the potential for qualitative growth has increased dramatically.”