(Re)in Summary

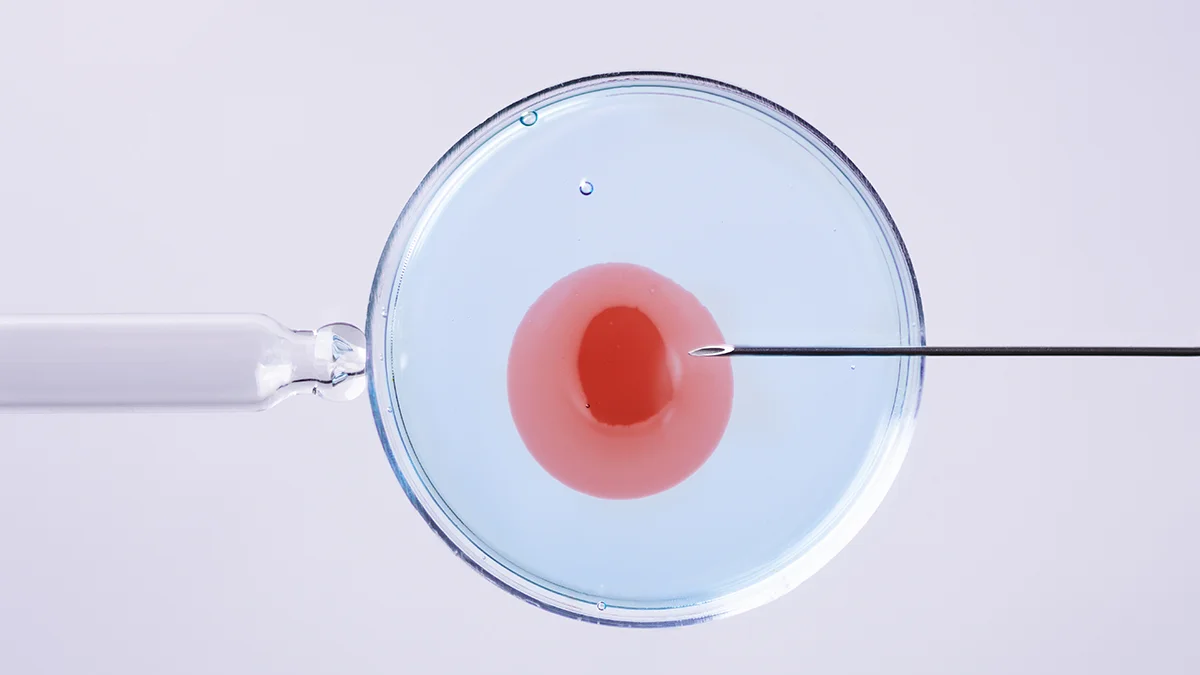

• Cally Myhrum Watts’ personal fertility journey led her to create Lotus Fertility Insurance, addressing a critical market gap in fertility coverage through B2B solutions.

• Prudential has achieved 50% female representation in tech roles while implementing AI-driven solutions in policy management and sales.

• At Solera and Peak Re, female executives are leading data standardisation and climate risk solutions.

There is a great shift in the insurance industry: women are increasingly taking the lead in driving technological innovation and market development. As shown at Insurtech Insights Asia Conference 2024, their collective expertise across technology, data analytics, human-centred design, and risk assessment is transforming traditional insurance models into more inclusive and responsive solutions for today’s diverse needs.

For one, women-led insurtech startups are breaking new ground in specialised coverage areas. Lotus Fertility Insurance’s Founder and CEO Cally Myhrum Watts’s personal fertility journey inspired her to create a B2B platform helping insurance carriers offer fertility coverage.

“I can’t say that I grew up dreaming to be in insurance. I never thought this was an industry I would find myself in,” she said. “It wasn’t until a couple of years ago, when I was looking into freezing my own eggs – early 30s, single, no kids on the horizon, very career-oriented – and just had a real lack of options around me in terms of affording it.”

Cally Myhrum Watts

Founder and CEO of Lotus Fertility InsuranceHer search for insurance coverage revealed a troubling gap in the market. “There really weren’t any options available to me. It has more to do with long-standing misunderstandings, misconceptions about fertility,” she explained.

This revelation led to a business solution. “[Insurance solutions that can be used in fertility] already exist, we just haven’t applied it to fertility yet. That’s what led me to get into insurance and we’re building a B2B solution, essentially helping carriers implement fertility protection alongside their existing insurance solutions,” said Watts.

The approach represents a paradigm shift that reframes fertility as a broader health issue rather than just a woman’s concern. “Something that insurers can do is lean into understanding what the experience[is] and how can we be creative in developing solutions that meet this unaddressed, unmet need that affects half of the population,” she said.

There is a paradox in the fertility solutions market, according to Watts. “What’s interesting about some of these fertility solutions or companies that are coming to market, is that a lot of the ones who are getting the funding either have a male CEO or male co-founder,” she observed. “When men understand and see themselves in the fertility journey, then they can see themselves as part of the equation, and therefore part of the solution.”

Despite tech leadership in insurance being traditionally male-dominated, the tide is turning.

“If I looked 10 years ago, technology was not the most attractive area for women, and I can still remember sitting there alone with my tech team, waiting for candidates,” said Prudential’s Chief Technology & Operations Officer Anette Bronder. “[Now,] around 50% of our people in technology are female. And I think that says a lot.”

Under Bronder’s leadership, Prudential is revamping its operational structures through AI-driven policy management and sales support, while carefully balancing automation with the human element.

“We have a lot of [AI] use cases. We bring it to scale right now in policy management, AI assistance for sales, along with the whole budgeting of the customer,” said Bronder. “In insurance, it’s important that we use AI technology and data in an efficient way that we can’t use [with] the human touch.”

Anette Bronder

Chief Technology & Operations Officer at PrudentialAt Solera, a company providing automotive software solutions, Data Insights Director Ana Izquierdo Feliz champions a similar data-driven approach to overseeing an extensive global data ecosystem. “What we do is to have [a] global common data lake in which we ingest all the different data sources, we normalise, standardise, clean up and prepare a single source of truth that is key for enabling other solutions later on,” she said.

This standardised approach is crucial for developing cutting-edge insurance solutions, particularly in environmental impact assessment. “In this framework of globalised, normalised data, we can apply the standard algorithm certified by the ISO to, for instance, calculate CO2 emissions on clay level, so we are able to provide Scope 1, Scope 2 and Scope 3 in a global area for all different things,” said Feliz.

Peak Re’s Vice President Luxi Zhou brought forth another perspective, focusing on bridging climate risk and insurance coverage. Her priority is developing solutions that are both advanced and accessible, not least for emerging markets. “The transparency, data and transparency in the model development is a very key part of the considerations for adopting any solutions,” she said.

“If we don’t have open documentation technology and clear data, linear, we risk creating black boxes that will be impossible, hard to validate and also to improve upon,” said Zhou. “Eventually, this will slow down the adoption of the technology and the solutions to the practical world.”

The discussion took an interesting turn during the Q&A session, touching on pressing issues like insurance coverage for menopausal women.

Watts highlighted a stark disparity in healthcare research funding: less than 5% of healthcare research dollars globally go towards women’s health, and less than 25% of that goes towards gynaecological or fertility-related research. “There is still so much more that our medical knowledge needs to expand and understanding women’s bodies and these transitions that we go through,” she said.

Among all the panellists, there is a consensus that diverse leadership is key to ensuring insurance solutions truly reflect and serve all population segments, particularly in addressing underserved markets. “If you want to bring healing to healthcare, fertility is a great place to start, because it’s the thing we all have in common,” said Watts.